Insurance companies love to discount your car insurance in their ads. It seems like these days it’s the only selling feature. Even Emus and lizards are out there offering to save you a few bucks by switching or paying only for what you need. For the most part, car insurance is a commodity purchase, and most people buy on price. But with pun fully intended, those discounts come at a cost to you.

As the person cutting the check, the insurance company is always looking to save money. They do this by strong-arming shops about what they are willing to or refuse to pay for. Another way they cut costs was to eliminate a vast and expensive portion of their payroll. This came in the form of the field adjuster. The camera on your smartphone and the internet access it has killed the field adjuster for many insurance carriers. What has taken its place is photo estimating.

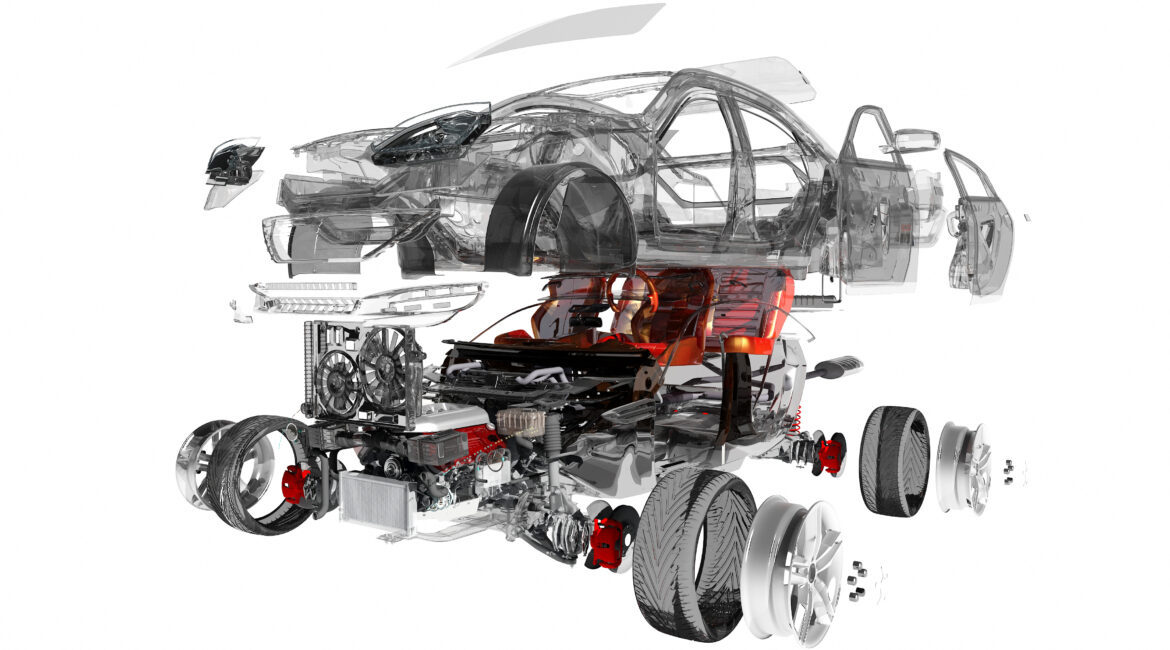

To the consumer, photo estimating appears great. You take a few photos of the damage, upload them, and a few days later, you have a check. The problem is the camera is not an X-ray camera, and there is no way of knowing if the car has additional damages, and let us tell you, most of the time they do, even on minor parking lot boo-boos.

Auto body shops hate them, and eventually, the body shop customers do too when they learn that there is more damage hiding under the panels, and the car is going to take longer to fix than the insurance company photo estimating system predicted.

A recent DEKRA presentation revealed how a low-speed collision into a trailer hitch could result in far more damage to a vehicle than was visible from the exterior.

During the Society of Collision Repair Specialists (SCRS), a talk by DEKRA Services Managing Director Christian Ruecker, the discussion raised serious questions about the value of photo estimating and parking lot damage assessments conducted by a repairer, consumer or insurer.

Ruecker called disassembly the “most crucial” part of the process.

DEKRA is a leading global safety testing and inspection firm that also manages more than 120,000 auto body repair claims annually from their facility in Germany. In their crash test facility, DEKRA ran a 2009 Mercedes C200 CDI T-Model at 6.1 mph into a trailer hitch mounted on an unbraked 2,932-pound barrier on wheels. The purpose was to simulate a very minor “bumper” bender or even being back into in a parking lot by a pickup truck.

From the outside, the damages appeared to be purely cosmetic, and if you could live with the scrapes, you might not even bother to have the car fixed, and choose to send a photo estimate in, and cash the insurance check instead.

The problem is that the photo estimates couldn’t see all the damage behind the bumper cover. And the lack of any major damage to the outside masked some significant and unsafe damage behind the cover.

What was damaged?

Exterior damage that you could see included the damaged license plate, a scratch on the grille, a dent in the bumper, and incorrect gaps between the hood and a headlight.

Then after a partial disassembly and removing the bumper cover revealed a large dent into the bumper reinforcement. The impact also deformed the power steering cooling tube, tore the air conditioning condenser, and damaged the radiator.

Not only were the bumper brackets pulled, demanding reinforcement, but one of the brackets also pulled the lower rail inward, indicating frame damage. What appeared to be a simple and very minor cosmetic repair is now a structural repair since the frame rail was compromised, and the vehicle is now unsafe to drive.

Using a fairly industry standard rate of $50 an hour for labor, the cost is more like $5,000 to repair this damage at most shops across the country. However, if we were to tell the customer that this is easily a $5,000 repair when the photo estimate from the insurance company says it is just under their deductible we often get accused of trying to overcharge the insurance company when in reality it is the insurance company who is trying to underpay you for the loss.

This is why it is so important for us to do even a partial tear down to determine the extent of damages beyond what we can see from the outside. It is also essential for us to do this so that we can give you the proper documentation you need to get the real value of your claim. It is the legal responsibility for the insurance company to reimburse you for the full amount that it takes to return your vehicle to the pre-loss condition.

If you are comparing two estimates: one from Hunter Auto Body, and one from our competitors, pay close attention to how many lines are written, how specific the parts and materials lists are and the labor times. If there is a wide spread between the two estimates, chances are the other estimate is missing crucial OEM procedures that are vital to the safety of the vehicle post repair. If you have any questions about any of our estimates, we are certainly happy to walk you through them.

Feel free to give us a call at (704)-881-0410. If you’d like to schedule an appointment or get an online quote, we’re more than happy to help out! We offer these on our website to make the car repair process as stress-free as possible! Just click any of the buttons below to get started!